Mabrian travel intelligence reveals key drivers of GCC inbound tourism and the top 10 outbound destinations

Powered by global travel intelligence company Mabrian, the 2024 Connecting Travel Insight Report explores GCC region travel and tourism from each member country's perspective, comparing the overall performance of the two first semesters of 2023 and 2024, as well as the top 10 outbound destinations for GCC travellers.

The GCC – or Gulf Cooperation Council – countries include the UAE, Saudi Arabia, Qatar, Oman, Bahrain and Kuwait, and the reports share compelling in-depth data sourced by Mabrian on the drivers of both inbound and outbound tourism to and from the GCC.

Launched in May 2024, the report also highlights opportunities for extending stays and embracing collaboration to create attractive multi-destination itineraries offering authentic experiences spanning the GCC.

Inbound Travel to the GCC

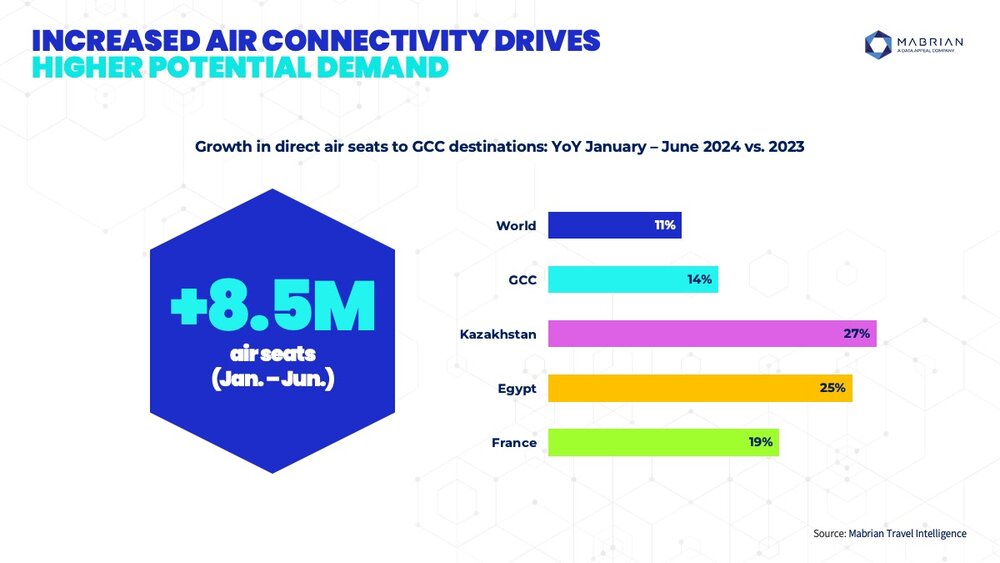

Focusing on international travel to GCC countries, the report indicates that air connectivity increased 11% year-on-year, meaning an extra 8.5 million seats were available than in the same period in 2023, contributing to increasing demand.

According to Mabrian’s analysis, huge potential lies in extending the length of stay in all six GCC counties. The figure currently stands at 3.46 days on average. By extensively promoting the variety of meaningful and authentic tourism experiences on offer and encouraging multi-destination trips to the region, this could be increased.

This strategy will also have a positive impact on the region’s Satisfaction Index of Tourism Products and Services, now at an average of 68 points out of 100, as authentic local experiences will better resonate with travellers.

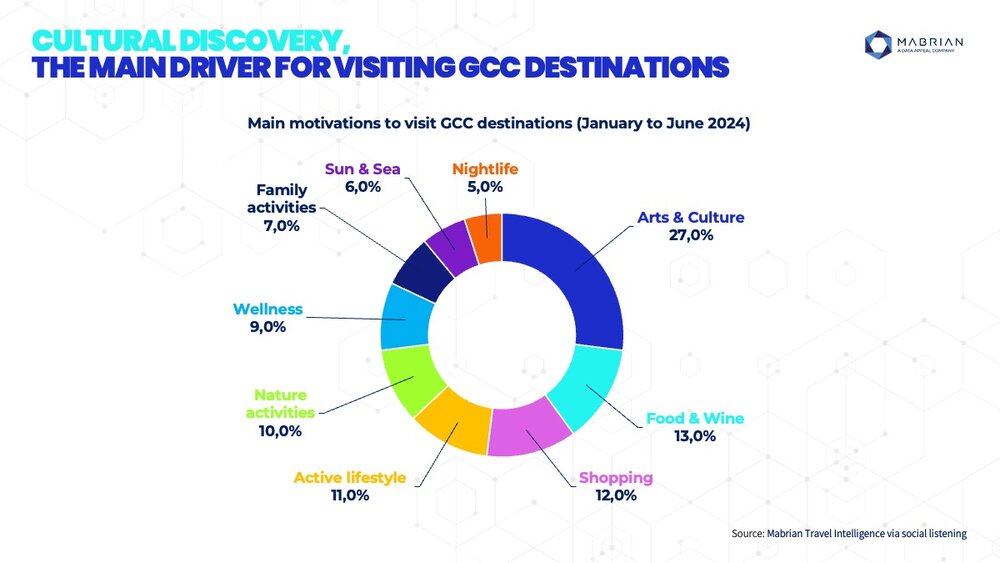

The key drivers for foreign visitation to the region are culture and arts (27%), gastronomy (13%) and active well-being (the combination of outdoor, wellness and active lifestyle pursuits), which is equivalent to 30% of the total share of all motivations to travel).

Data indicates that the Hotel Satisfaction Index, relating to the entire GCC region, reaches 67 out of 100 points on average, fluctuating more than 25 points from the highest to the lowest figures. There's therefore an opportunity in levelling hospitality standards across the region to build a more homogeneous perception of the accommodation experience in the GCC.

Mabrian data shows that safety and climate are great assets for GCC destinations in attracting international travellers, reflected in a 94-points Perception of Security Index, as well as the 90-points Climate Perception Index (of 100 points possible).

Highlighting other opportunities for growth, Carlos Cendra, Mabrian's marketing and communications officer, said: “The GCC's extensive tourism infrastructure development also creates opportunities to diversify in specific segments, enhancing MICE, business and bleisure travel sectors, and to appeal to other profitable demographics groups, including younger generations, as well as GenX (+45-years-olds) and silver travellers.”

DOWNLOAD THE FREE 2024 CONNECTING TRAVEL INSIGHT REPORT HERE

Outbound Travel from the GCC

GCC travellers show a strong preference for renowned bucket-list destinations, such as France, the UK and Italy, as well as culturally familiar destinations, such as Turkey and Egypt, and countries with breathtaking landscapes, including the idyllic islands of Thailand and the Maldives to the spectacular forests and mountains of Georgia, Switzerland or Azerbaijan.

The drivers that influence GCC travellers most when choosing a destination are active well-being pusuits, equivalent to 36% of the total share, while arts and culture and gastronomy represent 25% and 12% respectively.

The top 10 outbound destination identified by Mabrian data markers are:

- Turkey

- Thailand

- Egypt

- United Kingdom

- Italy

- Switzerland

- France

- Maldives

- Georgia

- Azerbaijan

“Understanding GCC market preferences and travel motivations is key to increasing the average length of stay of 4.2 days in their top 10 outbound markets," added Cendra.

Direct connectivity and safety are also big drivers for GCC travellers venturing abroad. Air capacity from January to June 2024 has grown 19% when compared to 2023, and in some markets, such as Azerbaijan, Thailand or Egypt the increase is more than 38%, 33% and +25% respectively, while Mabrian’s Perception of Security Index (PSI) data shows that the GCC market highly regards safety, as the average PSI of their 10 most popular destinations is 87 points out of 100, and is even higher for Thailand (96), Georgia (95), and France and Italy (93).

RELATED:

Inside the 2024 Connecting Travel Insight Report Launch

Mabrian unveils top 10 most connected destinations

Mabrian launches Middle East Tourism Barometer analysing Q2 2023

Founded in 2013, Mabrian (Mabrian Technologies) has been part of The Data Appeal company since 2023. It creates insights by combining big data analysis, artificial intelligence (AI) techniques and their team of consultant's deep knowledge of the tourism sector.

The company offers a visual data dashboard that provides a holistic observatory related to everything that affects a tourist destination: air connectivity, hotels, holiday rentals, travellers’ sentiment and demand, spending, mobility and sustainability. The analysis draws from more than 30 global data sources to identify and predict tourism dynamics.

Present in 40 countries, Mabrian provides services to tourist countries, regions and cities, as well as companies in the hotel and transport sector, and tourism-related consultancies in the fields of marketing, promotion, strategy and investment to help them make decisions based on continually updated data and the evolution of the context.

For more information, visit mabrian.com; to download the free report, click here

_w=940_h=488_pjpg.jpg?v=e5490446)

_w=640_h=335_pjpg.jpg?v=e5490446)

_w=640_h=335_pjpg.jpg?v=e5490446)

_w=640_h=335_pjpg.jpg?v=e5490446)

_w=640_h=335_pjpg.jpg?v=e5490446)